Share this post:

What you must do to become an ‘essential service’

The health threat of Coronavirus is only one of its threats – the other is the uncertainty and fear to those who aren’t infected. No one is immune from that, infected or not. At some point over the last few weeks we have all – at some point in our waking day or our sleeping night – felt anxious on some level about this.

What if I get it? How am I going to run the business? What if clients pull their assets or fire me?

Fear breeds anxiety, anxiety soon grows into despair and depression, and from this place poor decisions won’t be long in coming. It works that way for all of us.

When people feel threatened or overwhelmed, it’s a very natural reaction for them to go to ground and cancel everything but their essential services.

Gym membership — why pay for something I can’t use? That can go. The car service – we’ll put that on hold for now. The cleaners, the gardener – they can go too. I’m at home now I’ll do it myself.

What about financial planning? Is that a discretionary service or an essential one?

The better question to ask is what can we, as financial advisers, do to help people make smart choices here, including ensuring they don’t throw out their plans along with the relationships that helped build those plans? The goal is to become an essential service in a time of crisis.

So here are some ideas you can use right now to take the lead and protect your clients from making poor decisions.

Be indispensable to your clients

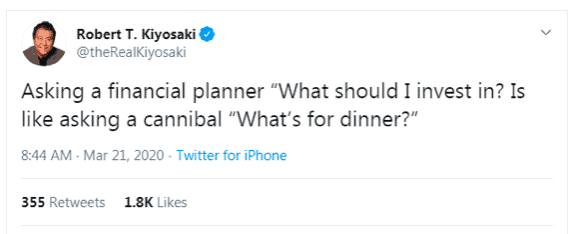

Let’s start with a remarkably offensive tweet from the Rich Dad Poor Dad guy, Robert Kiyosaki, a few days ago …

Say what you like about Kiyosaki, it doesn’t change the fact that as a financial planner it is hard work to build trust and confidence with a reputation like this floating around. Yet building trust and confidence in the face of this sort of adversity is precisely what’s needed.

Cementing yourself as an indispensable service in your client’s mind requires leadership. Leadership is really all about suspending your own needs to serve others, so that they get what it is they value most.

What do clients value most?

As financial advisers we have this habit of quantifying the value of our advice in dollar terms – this much saved in interest, this much extra made in returns, and so on. Be assured, this is very important — there must be some sort of quantifiable benefit to following our advice, otherwise it’s not really advice.

As important as that is, it’s still only tickets to the dance. The language of the client isn’t dollars and cents the advice saves you or makes you. What they value lies beyond that.

Clarity – unravelling the knot

Ever struggled with some big problem? One that kept you up at night? One that felt like a fog – you just couldn’t think it through and resolve it, you always wound up frustrated? Being stuck in this place breeds worry and good decisions in this space are rare indeed. We’ve all had this experience in one way or another, unable to unravel that Gordian knot.

How valuable was it, though, when the penny finally dropped? The missing link fell into place and suddenly you became lucid about the whole chain of the problem, the knot unravels right in front of you.

It’s extremely valuable to have some vexing obstacle that confounds you clarified so it’s no longer an obstacle. Being able to be crystal clear on a task or situation — having real clarity about an issue — is a great feeling. Clarity.

If you, as an adviser, can create an environment for your client to feel safe enough to explore their thinking, you can help them integrate all the disparate bits of information and rampant emotions to make sense of it all.

When I speak about exploring something complex, I’m not talking about giving someone a lecture or making a presentation to educate them on the intricacies of something complex. That is unlikely to inspire action. What use is an education unless it results in thoughtful action?

Instead I’m talking about patiently walking someone through their own thoughts so that they arrive at a sensible conclusion AND are compelled to take action on that right thinking. Financial planning is not designed to be an academic exercise.

Understanding – feeling heard

There’s value in feeling heard — someone listening attentively to you – because this means being understood, and being understood is priceless. The opposite is plain annoying. You’ve no doubt had the experience where you’d love to say to someone “I know you can hear me but it doesn’t feel like you’re listening to me”?

So much of our communication these days feels like the person you’re talking to is just waiting for you to finish so they can talk.

Suspend your desire to jump in there when they pause or take a breath. They’re processing, they don’t need your noise distracting them from that. We have a natural tendency to share our own experiences and opinions, and that’s helpful, but not before they’ve emptied their cup.

When I was a young insurance salesman we were taught that ‘telling isn’t selling’. The same principal applies in being someone’s trusted adviser and leader and guide – you can ask or you can tell. Spend more time in ask, that’s your job: ask high quality questions so that they can “empty their cup”.

Listen to the answer and ask a question related to their answer. This shows you are listening and that means you’re interested in them. People don’t care how much you know until they know how much you care. This shows them you care.

Impartiality – exploring all the options

When you feel overwhelmed or under pressure, your options seem to get squeezed; sometimes you can’t see any options at all and you’ll grab desperately at the lowest hanging branch. A deep pool of value is having someone there for you who can patiently help you explore all your options, weigh the pros and cons of each, and support you to make a decision on what to do.

Don’t be duped into thinking that action is where the value is. Sometimes the right thing to do is nothing at all. How valuable is it not to take that step forward which would have put you in front of the hurtling bus? This is the essence of advising.

A USA-based financial planner posted on LinkedIn recently when the social isolation and lockdowns were just starting to roll in: “this is why we give the boring, unsexy advice of having 6-12 months emergency cash sitting in an account somewhere … how valuable is that advice now?”.

Being impartial and focussing on the problem and canvassing options really frees you up to give more valuable advice.

Organisation – bringing order to chaos

People who want to plan their future naturally place value on feeling orderly. They spurn chaos in their lives.

Order can mean different things to different people – in our line of work we’re not just talking about having things in the right buckets, although that’s a good start. We’re talking about having clear goals which gives a client the direction they need and crave. Having direction means you can put together a plan which in turn gives you structure and a way to measure progress towards each goal.

More than that: it also means being organised enough to anticipate what needs to be done so that you can be better prepared for what is going to happen later this quarter, this year, later in your life and later on in the rest of your family’s lives.

But even more than that: being organised means anticipating the unlikely too. Rather than just react to events as they unfold like you’re rolling with the punches, you’re sufficiently organised that you’ve done some quality consideration of all the risks to your goals and your plans, and have then mapped out strategies to mitigate all these risks, plus laid down response plans if those unlikely events actually happen.

Bringing order to your life doesn’t mean being locked in or constrained. It frees you up to breathe so you can limit your worries to things that are within your control.

Perspective – seeing the bigger picture

At times like this when we are being bombarded daily with news about global events, it’s oh-so-easy to slip into overwhelm – particularly when we can’t keep up with the pace of change. It can help to bring your awareness back to what’s actually within your control because almost all of the emoti-bite drivel we see and hear on the news these days is beyond our control.

That doesn’t mean we have to ignore it necessarily, but it does put control over how you respond to the information back into your hands, and that is very comforting and reassuring. Certainly better than feeling out of control anyway – we call that ‘refocussing the client’.

Another skill that can provide reassurance and a sense of personal control is called ‘repositioning the client’. When you’re in the boiling cauldron it’s tough to look over the edge and imagine any other reality than the misery you’re feeling now. But what about when this is all over? Things might not necessarily return to business as usual – it might be a ‘new normal’ – but it won’t be like this. This, too, will end.

Asking a client to tell you what’s important about accomplishing their goals can reposition the conversation into something more productive than a spiral of anxiety.

Two other tools in your toolkit are ‘reprioritising’ and ‘reframing’.

Got a bunch of priorities, every one of them screaming at you for attention? Some are important, some are urgent. This sounds like overwhelm and it’s not fun. Where to start? What you want to start with is the tasks that are both important AND urgent. The only way to tell the difference is to understand your own personal hierarchy of what’s important to you, and know what your goals are. Now you have a tool to filter out the noise and see the forest as well as the trees.

Speaking of noise, when there’s too much we run the risk of jumping to conclusions that aren’t well considered. This can lead to dangerous action. Or at least actions we might come to regret. When you explain why you’re embarking on a certain course of action to someone and he or she makes it safe to explain your reasons, it can be helpful to ponder whether there might be another way to look at the situation because perhaps there are other factors at play here, as-yet unexamined information that might flesh out the picture a bit, and open up other options.

Get in touch to showcase your real value

Amid this crisis people are drowning in unproductive states fuelled by these unhelpful emotions.

They believe they don’t have options. They believe there is no solution. It’s all beyond their control. There’s no normal anymore. Plus it’s all happening at a pace – they don’t have the luxury of thinking things through properly. To make matters worse, everyone’s selling something — there’s no one you can trust to lead you through the minefield of your own mind.

To a greater or lesser degree we are all in this boat at the moment.

Pause for a moment and consider the value of having a relationship with someone you can trust who can create clarity, explore options, and provide direction. Someone who can make sense out of the chaos in terms of what you want to achieve for you and your family.

That’s priceless anytime, but particularly now.

Now pick up the phone and wield your value. That phone call will leave a trail of trust in its wake that you’ll find makes you an essential in their lives – someone who your client feels is essential to the future they want to make happen.

We invite you to join PIFA President Daniel Brammall next week for an exclusive live call, where he’ll share insights and answer your questions about how you can position yourself as a leader during turbulent times, and ensure your practice and your clients survive and thrive in the new reality.

Spaces are limited – click here to register for the call.